Still here?

Are you still in the oil and gas business? If you are one of the hundreds of thousands that have lost their job, do you plan to stay in the industry?

If you own a company, how is business going? Are you able to balance cash flow, cut costs and stay resilient until the inevitable upturn?

Perhaps you have bought into the hysteria and think that there will never be another upturn? That the industrial age is going the way of the dark, stone or ice ages? Perhaps you think that fossil fuel might be banned and that everyone will be switching to solar powered cars and nuclear mains electricity?

The peaks and troughs in the oil and gas business are so erratic that a career or a business in it could be seen as a huge gamble. Just staying in the industry is making a bet on it not being outlawed, or you being able to hold on to your job or company.

There are many that are folding under the pressure of trying to get a job, and moving to other industries. There are others that were planning to do a few more years but are cashing out their chips and planning a more careful retirement.

For the ones that are staying...

Is this a big mistake?

Are we doing the right thing by staying in the oil and gas business?

Only time will tell, but we at NatResPro are convinced that whilst this is the worst downturn in decades, the upside is likely to be spectacular. If we were to leave the business now, we will miss the rebound. The same applies to every business owner and individual worker. We have made it this far, we should keep going.

If you are going through hell, keep going...

Winston Churchill

The only reason that we would give up, would be if we thought that the oil business was really in perpetual decline and that we were part of a dying industry.

That might be the case from a 50 year viewpoint, I for one look forward to the day when we are not using any fossil fuel that causes pollution, when we are not throwing tons of plastic into the ocean. To move to renewable energy and biodegradable packaging and consumer goods is a shift that is likely to happen over the next 20-30 years anyway, but we are nowhere near that stage yet.

Until technology catches up, the oil business will provide a good living for all of us. Perhaps our children and grandchildren will work in hydro electric or even cold fusion power plants, but we can do very well as we are. As long as we hold on.

Oilpro.com is always a good source of information

The reason for me writing this is related to a few posts over on oilpro.com that I saw today that got me thinking...

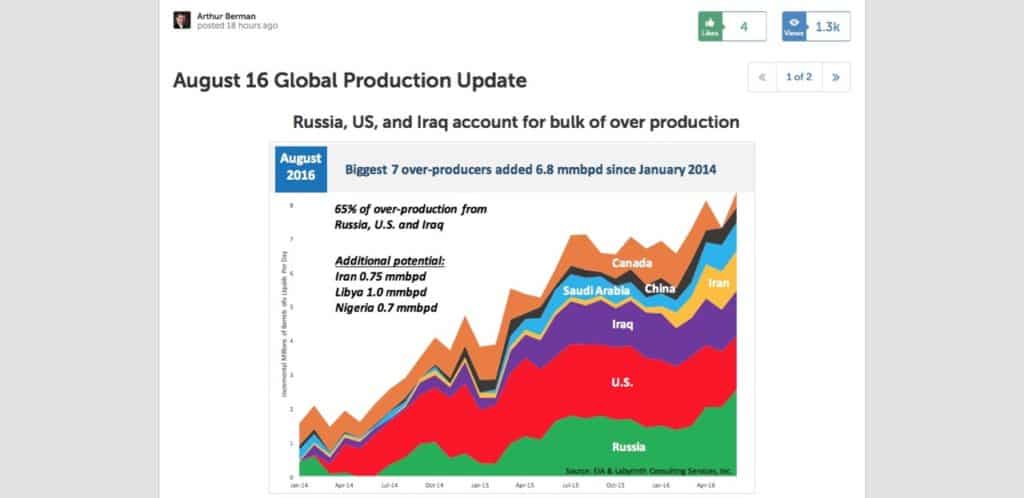

The first post I saw was a graph that was submitted by Arthur Berman:

Arthur is a well known and well respected person on the oil and gas business, the charts source is from the EIA and Labyrinth Consulting Services Inc. It is clear that during the last couple of years, oil production has skyrocketed all over the world. The reports of storage facilities and tankers getting closer to capacity back up these figures.

The 'beggar thy neighbor' and 'race to the bottom' reports seem to be accurate based on charts like this, and the next ones that I saw.

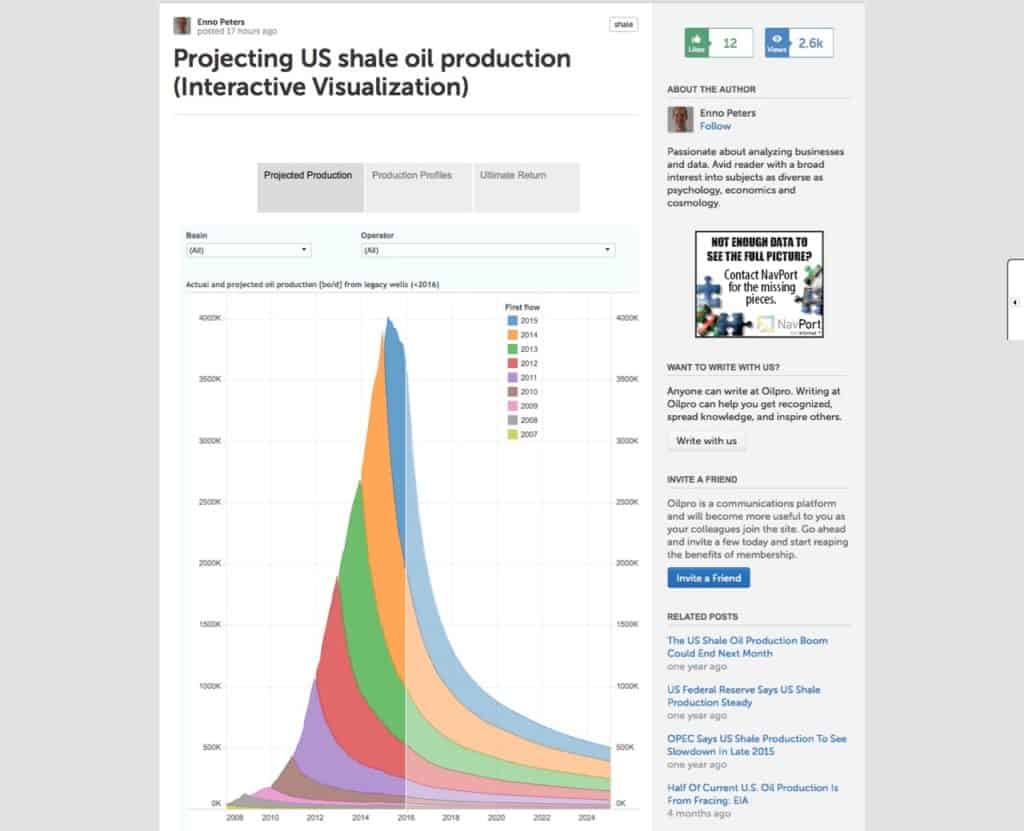

The next article was posted by Enno Peters who tracks and charts the official shale oil production figures:

Enno Peters posts these updated graphs on his website and then shares them with the Oilpro readers. If you go to Enno's website you will truly understand the meaning of a picture being worth a thousand words.

These graphs show the US explanation of the oversupply situation. No doubt there could be graphs and explanations for each country that has opened the supply taps to the maximum.

What is also telling is the rate of reversal. Factors such as depletion rates and cash flow issues are resulting in rapidly declining supply.

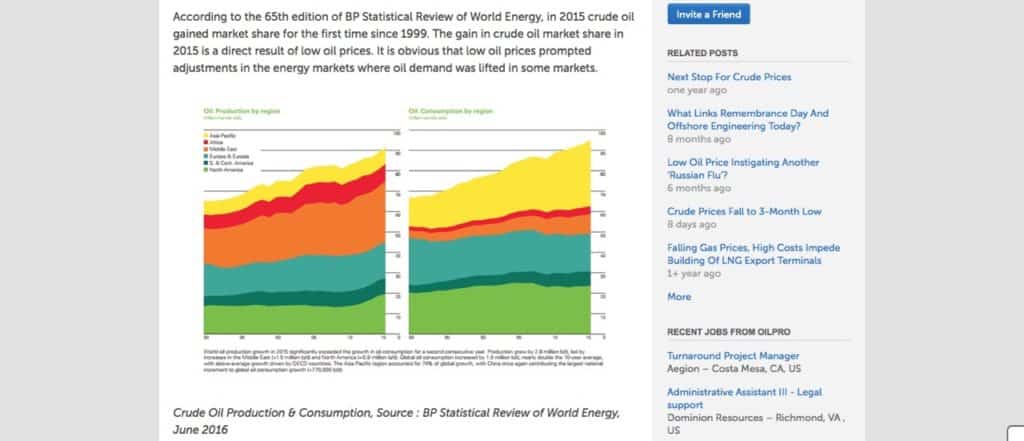

Lastly, there was a more general article by

< Getting your CV noticed Why are you always so positive? >